General Giving Information

What are the different ways I can give to SOU?

You can give to SOU through various methods, including:

- Online giving: Donate directly through our website.

- Checks: Make checks payable to Southern Oregon University and mail them to the Office of Advancement.

- Gifts of securities: Transfer stocks, bonds, or other securities.

- Planned giving: Explore options like bequests, trusts, and charitable gift annuities.

Is my donation tax-deductible?

Yes, your donation to Southern Oregon University is generally tax-deductible. Please consult with your tax advisor for specific information on the deductibility of your donation based on your individual circumstances.

How can I make a recurring donation?

You can set up a recurring donation here. This allows you to make regular contributions to support SOU on a monthly, quarterly, or annual basis.

What is the Foundation’s Employer Identification Number (EIN)?

The SOU Foundation is a registered 501(c)3 organization. Our Federal Tax ID is 23-7030910.

I have additional questions. Who do I contact?

You can contact the Office of Development by emailing us soufoundation@sou.edu or call 541.552.6127.

Specific Giving Areas

Can I designate my donation to a specific program or department?

Yes, you can designate your donation to a particular program or department that aligns with your interests. For example, you could support the School of Arts and Communication, the Business program, or a specific academic program within the university.

How can I support student scholarships?

Your donation can directly impact student success by providing scholarships. You can choose to fund a specific scholarship or contribute to a general scholarship fund. By supporting scholarships, you are helping to make a difference in the lives of talented students.

Can I make a gift in honor or memory of someone?

Absolutely! You can make a gift in honor or memory of a loved one. We will notify the recipient or their family of your gift and provide them with a personalized acknowledgment.

Planned Giving Options

What is planned giving?

Planned giving involves making a donation that will benefit SOU in the future. It can include options like bequests, trusts, and charitable gift annuities. Planned giving allows you to make a significant impact on the university while also meeting your personal financial goals.

How can I learn more about planned giving?

Our Office of Advancement can provide you with detailed information about planned giving options and their benefits. We can help you explore the different ways to make a planned gift and understand the tax implications.

Can I discuss planned giving options confidentially?

Yes, our staff is committed to providing you with a confidential and personalized experience. We will work with you to understand your goals and find the best planned giving option for you.

Donor Impact Stories

Love for Theatre Leads to New Scholarship

Shared passion is often one value that holds a couple together—and Linda Hammer-Brown and David Brown are no exception to this truism. Their passion for the arts has translated to a contribution to the theatre program.

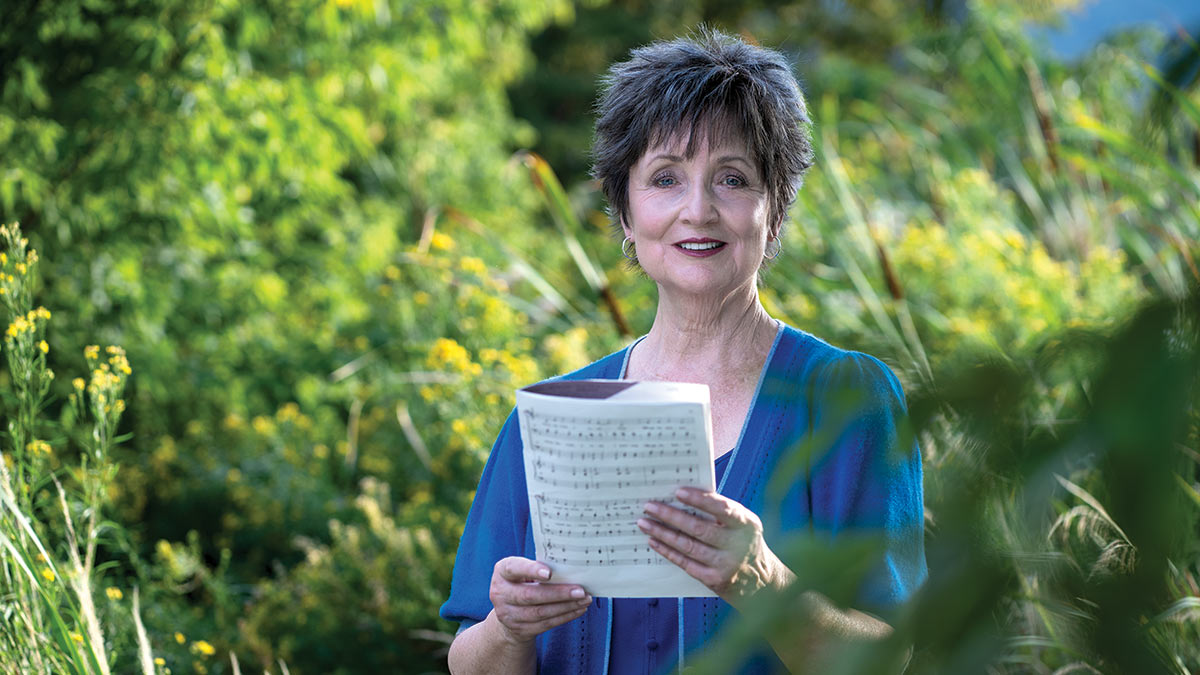

Gift to Music Honors Donor’s Agricultural Heritage

Kristy Henshaw Denman’s journey from a Willamette Valley farm to a passionate supporter of Southern Oregon University exemplifies the power of family and its influence on one’s aspirations. It was a love for music and children that led her to SOU.